- Home

- Blog

- Buying Guide

- Buying Off-Plan Property in Turkey: The Complete Guide

Buying Off-Plan Property in Turkey: The Complete Guide

Off-plan and under-construction properties in Turkey present an appealing investment opportunity for international buyers. Purchasing a home in Turkey during the early phase can help you gain instant equity and maximize potential returns, without relying on the regional value appreciation.

However, many investors often avoid investing in off-plan properties due to concerns about safety. After all, spending your years of savings on a property that isn’t built yet can feel risky, especially with fears of construction delays or misleading advertisements.

The truth is, while risks exist, they are manageable. As long as you are aware of red flags and understand the Turkish property laws, there is no reason to avoid what could be a very fruitful investment.

On this page, we are offering a complete guide to off-plan property investment in Turkey, including pros, cons, and legal protections you must know before signing any document.

What is an Off-Plan Property in Turkey?

Off-plan property in Turkey refers to purchasing real estate that is still in the planning or construction stage, rather than a completed unit. Buyers typically purchase these properties directly from developers. While this means that the property cannot be occupied for 12 to 36 months, buying a home at the project stage is a highly strategic investment move. The prices during project launch tend to be 20% - 40% lower than the market average. As the construction progresses, prices increase accordingly, and investors can obtain a significant ROI (return on investment).

Pros and Cons of Buying an Off-Plan or Under-Construction Property in Turkey

If you haven’t decided whether to buy an off-plan or ready-to-move property, understanding the advantages and disadvantages of off-plan properties in Turkey can be helpful. Here is a summary table:

Pros | Cons |

|---|---|

Lower Prices: Typically 20% to 40% lower than market value. This helps first time buyers and those with a lower budget enter luxury segment markets more easily. | Visualization: Off-plan properties enter the market with architectural plans and 3D renders. You cannot see the physical product yet. |

Payment Plans: Long installment periods that sometimes continue even after the key-delivery stage (often up to 24-48 months). | Market Fluctuations: If the installment payments will increase annually, fluctuations in exchange rates during the construction period may affect your financial planning. |

Higher Capital Appreciation: Off-plan properties start at low launch prices, and gradually gain appreciation by the time of completion. This means that, you can secure instant profit within a couple of months. | Construction Delays: Due to administrative or financial issues, the construction may not be completed within the promised time window. |

Customization: Many off-plan projects allow buyers to customize finishes and layout. This saves you money and time if you have very specific expectations for your home. | Developer Bankruptcy: Most developers finance the project via the income from sold units. If they don’t receive the estimated demand, the project may stop. |

You can refer to our related page for a deeper comparison of off-plan, new, and resale properties.

Is it Safe to Buy Off-Plan Property in Turkey?

Yes, buying off-plan property in Turkey is generally safe, provided that investors follow the correct legal procedures.

The Turkish real estate market operates under strict regulations designed to protect buyers. While risks like delays can happen, the legal framework ensures that your capital is protected against fraud. The biggest harm investors typically face is a loss of time and energy; you don’t lose your entire investment as long as you only sign legitimate contracts.

Here are the key safety mechanisms you must rely on:

Strict Government Regulations: Law on Consumer Protection

Under the Law on Consumer Protection (No. 6502), for any project with 30 or more units, the developer is legally required to secure buyers' payments against non-delivery. They must provide one of the following guarantees:

- Bank Letter of Guarantee

- Progress Payment System (Hakediş)

- Linked Credit Insurance

*Important Note: For boutique projects with fewer than 30 units, providing these specific guarantees is not mandatory. If you are buying into a smaller project, you must explicitly ask the developer how your payments are secured before signing.

Notarized Sales Promise Contract (Noter Satış Vaadi)

A simple contract signed in a sales office is not legally binding for title transfer in Turkey. For an off-plan contract to be valid and protect your rights in court, it must be signed at a public notary. This prevents the developer from selling the same unit to multiple people.

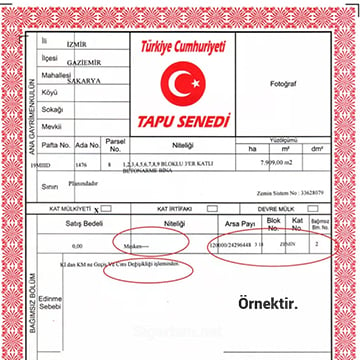

Title Deed with Construction Servitude (Kat İrtifakı)

There are generally three types of title deeds in Turkey. For off-plan projects, a specific type called "Kat İrtifakı" applies. This document registers your ownership of the specific land share allocated to your unit from day one. Even if the developer faces bankruptcy, your ownership rights on the land remain secure.

How to Verify the Developer in Turkey?

Always work with a developer who offers full transparency during real estate sales. This is the foundation of a safe investment.

To ensure you are dealing with a reputable company, follow these 4 tips:

Check the Developer’s Track Record: Investigate the developer's previously completed projects and review buyer testimonials. If you are considering a company with a history of delays, demand formal financial guarantees before proceeding.

Verify Trade Registry (Ticaret Odası): Every legitimate construction company in Turkey must be registered with the local Chamber of Commerce. To investigate, you can request the company’s tax number and registration details and use official digital portals.

Due Diligence: Due diligence in Turkey is essential. Inspect the title deed and understand if the developer holds all the valid construction and sales permits. Also, verify that the land title is free of heavy mortgages or liens (haciz) that could block your future transfer.

Get Legal Support: Working with a professional real estate lawyer is the most effective safety net. Never sign a contract without a professional legal review. You may consult TEKCE Real Estate’s in-house lawyers throughout the process to conduct a formal background check on the developer and review the contract’s penalty clauses to ensure your capital is 100% secure.

What Are the Questions to Ask When Buying Property Off-Plan in Turkey?

Before committing your capital, you must evaluate three critical pillars to ensure maximum ROI and minimize risks.

Before committing your capital, you must evaluate three critical pillars to ensure maximum ROI and minimize risks.

- Consider Future Infrastructure & Connectivity:

Since off-plan projects take 18-36 months to complete, the value of your property depends heavily on what will be built around it during that time. Pay attention to the transportation links, new airports, universities, or shopping malls. These infrastructures naturally drive rental demand. If the area is under an urban transformation, you will likely have the highest returns.

- Define Your Investment Goal

Before you buy, you must know how and when you will sell. This generally depends on whether you are looking for quick capital gains or long-term rental income.

- Tax Considerations: Remember that in Turkey, if you sell the property after holding it for 5 years, you are exempt from Capital Gains Tax. This is crucial for maximizing your net profit.

- The Flip Strategy: If you are planning to sell the property immediately upon completion, it is best to invest in a high-demand liquid market.

- Long-Term Rental Income: If your goal is passive income, start by analyzing the average rental yields in the neighborhood.

- Short-Term Rental Income: Under Turkish laws, not all properties qualify for a Touristic Rental Certificate. To legally rent out a property for short periods, the building must meet specific criteria. Before buying, ask the developer if the project's management plan permits short-term commercial rentals.

- Understand Currency Fluctuations & Financial Planning

For international buyers, currency fluctuation is a major factor.

- Payment Plan Currency: Most off-plan property payment plans in Turkey are fixed to USD or EUR to protect against inflation, but some may list in Turkish Lira (TL). Understand the currency your contract is pegged to.

- Installment Flexibility: Check if the installments are fixed or if they fluctuate with inflation rates. A fixed-price contract in a hard currency is often the safest option for foreigners.

Frequently Asked Questions About Off-Plan Property Investment in Turkey

How to buy off the plan property in Turkey?The process involves 6 general steps:

1) Due Diligence: Before making any payments, verify the Title Deed status and check the developer’s record.

2) Reservation: Once you select a unit, pay a deposit to freeze the price.

3) Legal Preparation: Obtain a Turkish Tax ID number and open a bank account.

4) Notarized Contract: Sign the “Sales Promise Contract” at a public notary.

5) Payment & Title Deed: Transfer the payment to the developer’s official bank account and receive your Title Deed.

6) Handover: Upon completion of the project, conduct a check of defects and receive the keys.

Is it worth buying off-plan property in Turkey?Yes, there are numerous benefits of buying off-plan property. First of all, these homes are significantly cost-effective, sold at a much lower price than market value compared to ready-to-move properties with similar features. Secondly, they offer larger capital appreciation, as prices are lowest at the launch phase and increase as construction progresses. Finally, developers typically offer interest-free payment plans ranging from 24 to 48 months. So, luxury properties become accessible even for first-time investors.

Which is better: off-plan vs ready property in Turkey?It depends on your goal. Ready properties are ideal if you need immediate residency or instant rental income, but they are more expensive. Off-plan properties are better for maximum ROI (Return on Investment) and budget flexibility. If you can wait 12-24 months, buying off-plan allows you to profit from the price appreciation that occurs during construction.

Is off-plan property a good investment in Turkey?Yes, specifically for capital gains. Historical data shows that off-plan properties in high-demand areas (like Istanbul or Antalya) can appreciate by 20-40% by the time construction is finished. It is the most profitable entry point for investors looking to buy at low prices and sell at high.

Is buying off-plan property in Turkey safe for foreigners?Yes, it is safe as long as you follow the correct legal procedures. Turkish law protects foreign buyers through the Consumer Protection Law (No. 6502). To ensure safety, always insist on a Notarized Sales Contract and verify the land title status. Hiring an independent lawyer is the best way to avoid risks.

Are off-plan contracts legally binding in Turkey?Yes. A "Preliminary Sales Contract" (Satış Vaadi Sözleşmesi) signed exclusively at a public notary is legally binding and can be annotated on the Title Deed registry. Standard contracts signed only between the buyer and seller in an office do not offer the same level of legal protection in court.

What are the risks of buying off-plan property in Turkey?The main risks include construction delays, receiving a unit that differs from the showroom quality, or the project being cancelled due to the developer's bankruptcy. To minimize these risks, choose well-established developers with a proven track record and ensure your contract includes penalty clauses for late delivery.

What happens if a developer fails in Turkey?Under the Consumer Protection Law, developers of large projects (30+ units) are required to provide Building Completion Insurance or a bank guarantee. If the developer goes bankrupt or fails to deliver, this insurance is designed to refund your payments. In some cases, another firm may complete the project.

How to avoid off-plan property fraud in Turkey?The most effective way is to work with a legit firm and sign the contract at a public notary, not just in the sales office. A simple sales office agreement is not sufficient to claim rights on the title deed. Additionally, never make payments to personal bank accounts; always deposit money into the official company bank account mentioned in the contract.

How to check the construction company in Turkey?The most reliable method is to use Turkey’s official e-Government portal (e-Devlet). You can verify the developer's legal status and active certificates by searching for "Müteahhit Bilgileri Sorgulama" (Contractor Information Inquiry) on the system. Additionally, check their registration with the local Chamber of Commerce (Ticaret Odası) and visit their past projects to inspect the quality.

What should investors check before buying off-plan in Turkey?Investors must check three key documents:

1) The Title Deed (Tapu) of the land to ensure there are no liens or mortgages

2) The Building License (Yapı Ruhsatı) to confirm the project is legal

3) Penalty terms for delays to secure your finances

Also, investigate the project's location to understand future infrastructure plans, like metro lines, to get the best out of your investment.

How to secure a mortgage when buying a property off-plan in Turkey?Generally, Turkish banks do not offer mortgages for off-plan properties until they reach a certain level of completion (usually 80%). However, developers fill this gap by offering easy payment plans. You can pay a down payment and pay the rest in monthly installments (usually up to 36-48 months) directly to the construction company, often with 0% interest.